Crafting Your Insurance Job Cover Letter

A well-crafted insurance job cover letter is a crucial tool for showcasing your qualifications and securing an interview. It serves as your initial introduction to a potential employer, providing a concise summary of your skills, experience, and enthusiasm for the role. Unlike a resume, which is a factual account of your career, a cover letter allows you to personalize your application, demonstrating your personality and explaining why you are the perfect fit for the specific position and the company. Taking the time to create a compelling cover letter significantly increases your chances of being noticed and considered for the job.

Understanding the Purpose of a Cover Letter

The primary goal of an insurance job cover letter is to convince the hiring manager to read your resume and invite you for an interview. It is not merely a repetition of your resume; instead, it expands on the key aspects of your qualifications and provides context. It allows you to connect your skills and experience to the specific requirements of the job description, highlighting your suitability for the role. A strong cover letter showcases your communication skills, attention to detail, and understanding of the insurance industry. It is also an opportunity to demonstrate your genuine interest in the company and the position.

Highlighting Your Skills and Experience

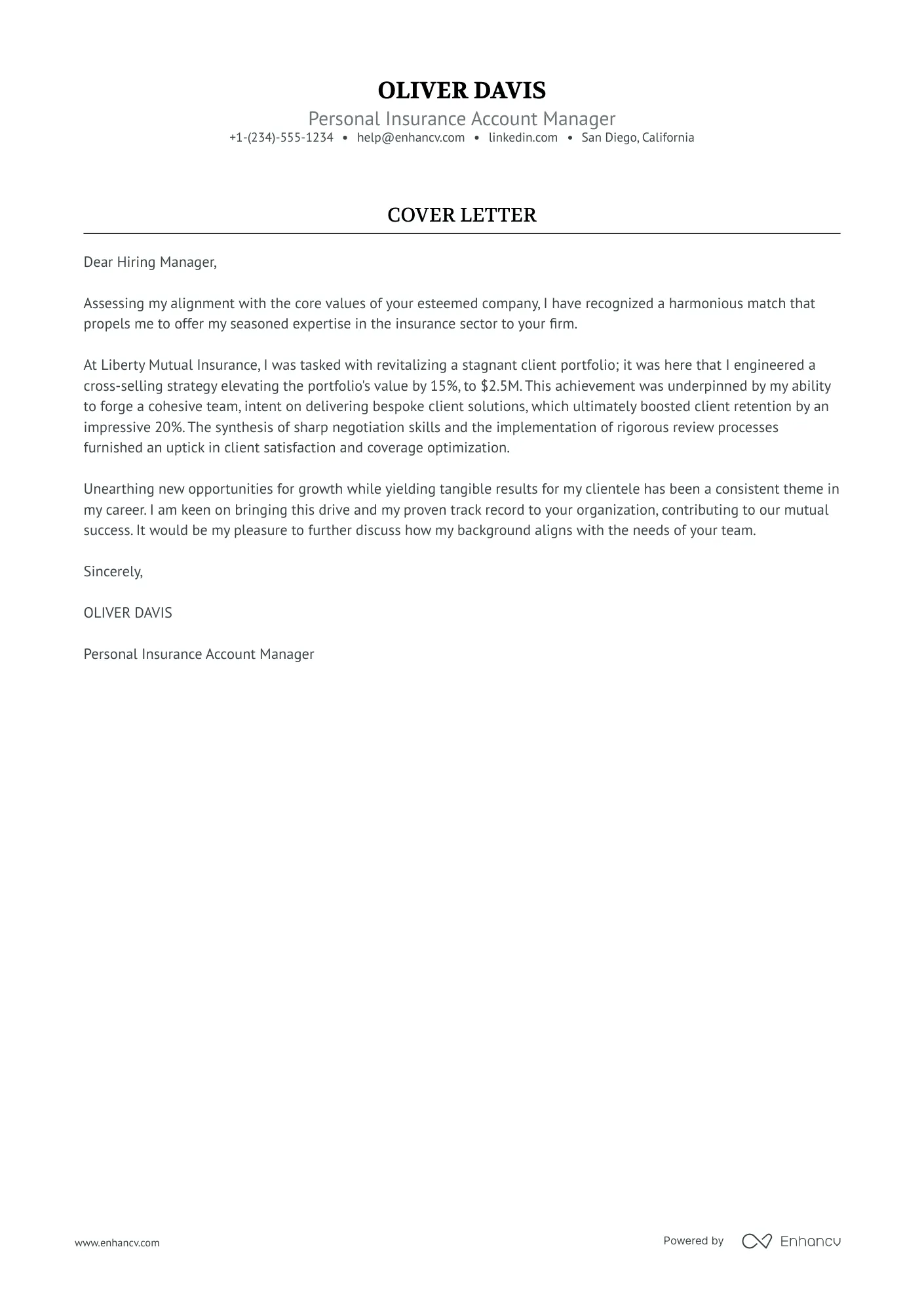

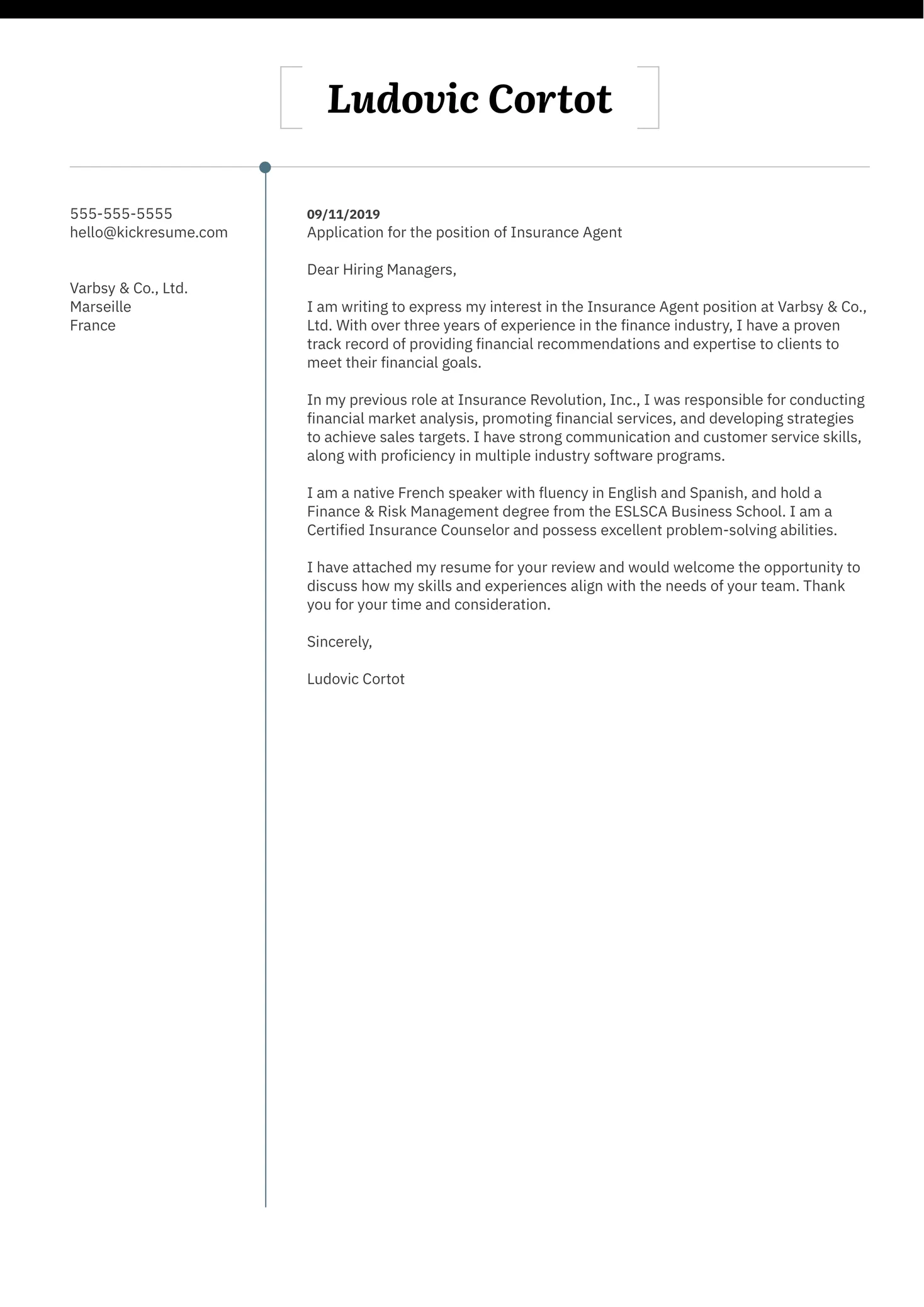

Focus on the skills and experiences that are most relevant to the job you are applying for. Identify the key requirements outlined in the job description and tailor your letter to address them directly. Provide specific examples of how you have utilized these skills in previous roles and the positive outcomes you achieved. This might include your experience in customer service, sales, risk assessment, claims processing, or underwriting. Quantify your achievements whenever possible, using numbers and data to demonstrate the impact you have made. For example, you could mention increasing sales by a certain percentage, reducing claims processing time, or improving customer satisfaction scores. Refer to image insurance-job-cover-letter-skills.webp

Researching the Insurance Company

Before writing your cover letter, thoroughly research the insurance company. Understand their mission, values, and the specific products or services they offer. This will enable you to tailor your letter to their specific needs and demonstrate your genuine interest in working for them. Visit their website, read their press releases, and check their social media presence. Identify any recent company achievements, industry recognition, or community involvement. Mentioning specific company initiatives or values in your cover letter shows that you have done your homework and that you are genuinely interested in joining their team. Refer to image insurance-company-research.webp

Structuring Your Insurance Job Cover Letter

Header and Contact Information

Start with a professional header that includes your full name, contact information (phone number, email address, and LinkedIn profile URL if you have one), and the date. Include the recipient’s name, title, and company address. Ensure your contact information is accurate and up-to-date, as this is how the employer will contact you for an interview. Use a clear and easy-to-read font, and maintain a consistent format throughout your cover letter.

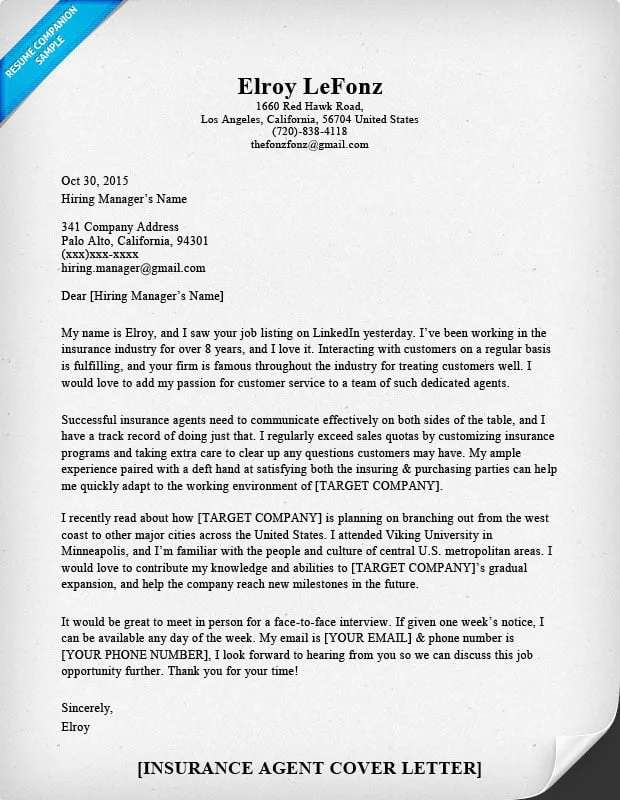

Greeting and Introduction

Address the hiring manager by name if possible. Research the hiring manager’s name on LinkedIn or the company website. If you cannot find a specific name, use a professional greeting like “Dear Hiring Manager.” In the introduction, state the position you are applying for and how you learned about the opportunity. Briefly mention why you are interested in the role and the company. Make a strong first impression by immediately capturing the reader’s attention.

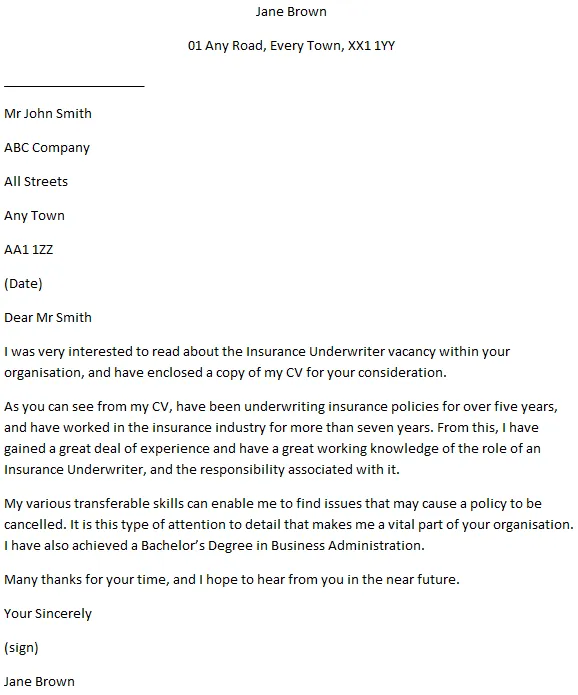

Body Paragraphs

The body of your cover letter is where you showcase your qualifications and explain why you are a good fit for the job. Use 2-3 paragraphs to highlight your relevant skills, experience, and achievements. Tailor each paragraph to the specific requirements outlined in the job description. Use strong action verbs to describe your accomplishments, such as “managed,” “developed,” “achieved,” and “implemented.” Provide specific examples to illustrate your skills and demonstrate your impact.

Why You’re a Great Fit

Explain why you are a great fit for the job and the company. Connect your skills and experience to the specific requirements of the role. Demonstrate your understanding of the insurance industry and the challenges the company faces. Show how your skills and experiences align with the company’s values and mission. Highlight your passion for the insurance industry and your desire to contribute to the company’s success.

Quantifying Your Achievements

Whenever possible, quantify your achievements using numbers and data. This adds credibility to your claims and demonstrates the impact you have made in previous roles. For example, instead of saying “improved customer service,” say “increased customer satisfaction scores by 15%.” Provide metrics that showcase your sales performance, efficiency gains, cost reductions, or other relevant accomplishments. Refer to image quantify-achievements.webp

Closing and Call to Action

In your closing paragraph, reiterate your interest in the position and thank the hiring manager for their time and consideration. Express your enthusiasm for the opportunity to discuss your qualifications further. Include a clear call to action, such as “I look forward to hearing from you soon” or “I am available for an interview at your earliest convenience.” End with a professional closing, such as “Sincerely” or “Best regards,” followed by your typed name.

Proofreading and Editing

Before submitting your cover letter, proofread it carefully for any grammatical errors, spelling mistakes, or typos. Errors can create a negative impression and undermine your credibility. Read your letter aloud to catch any awkward phrasing or inconsistencies. Ask a friend or family member to review your letter for feedback. Ensure that your cover letter is well-organized, easy to read, and free of errors.

Common Mistakes to Avoid

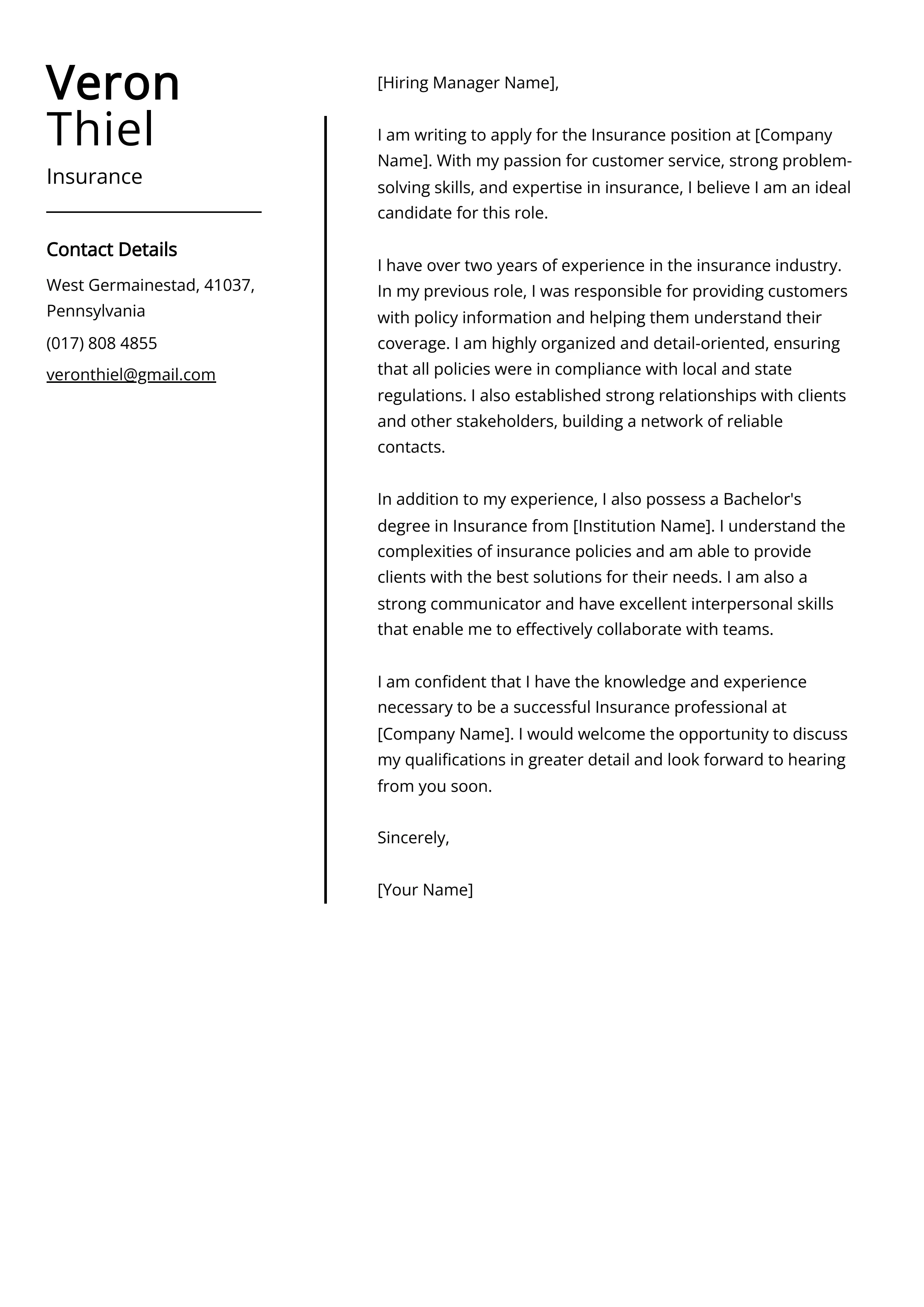

Avoid common mistakes that can hurt your chances of getting hired. Do not simply repeat your resume; instead, expand on your qualifications and provide context. Avoid generic cover letters; tailor each letter to the specific job and company. Do not use jargon or overly complex language. Avoid negative statements or complaints about previous employers. Do not include irrelevant information or personal details. Ensure that your cover letter is concise and focused, typically one page in length. Be sure that image cover-letter-header.webp matches the header contact details

Formatting Your Insurance Job Cover Letter

Use a professional and consistent format for your insurance job cover letter. Choose a clear and readable font, such as Times New Roman, Arial, or Calibri, with a font size of 11 or 12 points. Use single spacing and left alignment. Include a professional header with your contact information and the date. Use headings and bullet points to organize your content and make it easy to read. Keep your cover letter concise, typically one page in length. Refer to image cover-letter-formatting.webp.

Tailoring Your Letter for Each Job

Customize your cover letter for each job you apply for. Review the job description carefully and identify the key requirements and qualifications. Highlight the skills and experiences that are most relevant to the specific role. Research the company and demonstrate your understanding of their business and values. Avoid sending generic cover letters; tailor each letter to the specific job and company. This personalized approach will significantly increase your chances of getting noticed.

Keywords and Applicant Tracking Systems (ATS)

Many companies use Applicant Tracking Systems (ATS) to screen applications. To ensure your cover letter gets past the ATS, use relevant keywords from the job description. Integrate these keywords naturally into your cover letter without keyword stuffing. Focus on the key skills, qualifications, and experience that the employer is seeking. Optimize your cover letter for ATS by using a clear and concise format, avoiding complex formatting, and ensuring your contact information is easily accessible. Refer to image keywords-ats.webp.

Demonstrating Enthusiasm and Professionalism

Demonstrate your enthusiasm for the position and the company throughout your cover letter. Show your genuine interest in the insurance industry and your desire to contribute to the company’s success. Use professional language and maintain a positive tone. Proofread your cover letter carefully to ensure it is free of errors and typos. Present yourself as a professional, enthusiastic, and well-qualified candidate. Your cover letter is a reflection of your professionalism; make it count!

Follow-up Strategies

After submitting your cover letter and resume, follow up with the hiring manager or recruiter. Send a brief email or make a phone call a week or two after submitting your application to reiterate your interest and inquire about the status of your application. This demonstrates your proactive approach and your continued interest in the position. Express your gratitude for their time and consideration. Be polite and professional in your follow-up communication.